Markets

Visualizing Every Company on the S&P 500 Index

Subscribe to the Advisor Channel free mailing list for more like this

S&P 500 Companies: A Complete Visual Breakdown

This was originally posted on Advisor Channel. Sign up to the free mailing list to get beautiful visualizations on financial markets that help advisors and their clients.

S&P 500 companies hold $7.1 trillion in assets, and account for close to 80% of available market capitalization on U.S. stock exchanges.

The index serves as a barometer for the U.S. stock market, covering the largest public U.S. companies by market capitalization. Often, it reflects investor sentiment and is considered an indicator for U.S. economic health.

As the S&P 500 enters a bull market after the longest downturn in decades, the above graphic shows the entire makeup of one of the world’s largest markets.

Top S&P 500 Companies, by Weight

Here are the 100 biggest S&P 500 companies by sector and weight, using data from Slickcharts. Data is as of May 5, 2023.

Rank, by Weight | Name | Sector | Weight (%) |

|---|---|---|---|

| 1 | Apple | Info Tech | 7.46 |

| 2 | Microsoft | Info Tech | 6.69 |

| 3 | Amazon.com | Consumer Discretionary | 2.72 |

| 4 | Nvidia | Info Tech | 2.04 |

| 5 | Alphabet Inc. Class A | Communication Services | 1.82 |

| 6 | Berkshire Hathaway | Financials | 1.69 |

| 7 | Alphabet Inc. Class C | Communication Services | 1.59 |

| 8 | Meta Platforms | Communication Services | 1.50 |

| 9 | UnitedHealth Group | Health Care | 1.34 |

| 10 | Tesla | Consumer Discretionary | 1.32 |

| 11 | Exxon Mobil | Energy | 1.29 |

| 12 | Johnson & Johnson | Health Care | 1.23 |

| 13 | JPMorgan Chase | Financials | 1.16 |

| 14 | Visa | Financials | 1.09 |

| 15 | Procter & Gamble | Consumer Staples | 1.06 |

| 16 | Eli Lilly | Health Care | 0.98 |

| 17 | Mastercard | Financials | 0.94 |

| 18 | Merck & Co. | Health Care | 0.86 |

| 19 | Home Depot | Consumer Discretionary | 0.85 |

| 20 | Chevron | Energy | 0.82 |

| 21 | PepsiCo | Consumer Staples | 0.77 |

| 22 | Broadcom | Info Tech | 0.76 |

| 23 | AbbVie | Health Care | 0.76 |

| 24 | Coca-Cola | Consumer Staples | 0.72 |

| 25 | Costco | Consumer Staples | 0.64 |

| 26 | McDonald's | Consumer Discretionary | 0.63 |

| 27 | Pfizer | Health Care | 0.62 |

| 28 | Thermo Fisher Scientific | Health Care | 0.62 |

| 29 | Walmart | Consumer Staples | 0.62 |

| 30 | Salesforce | Info Tech | 0.57 |

| 31 | Abbott Laboratories | Health Care | 0.56 |

| 32 | Bank of America | Financials | 0.56 |

| 33 | Cisco Systems | Info Tech | 0.55 |

| 34 | Walt Disney Company | Communication Services | 0.53 |

| 35 | Linde plc | Materials | 0.52 |

| 36 | Comcast Corporation | Communication Services | 0.49 |

| 37 | Accenture | Info Tech | 0.48 |

| 38 | Adobe | Info Tech | 0.46 |

| 39 | Danaher | Health Care | 0.46 |

| 40 | Verizon | Communication Services | 0.46 |

| 41 | NIKE | Consumer Discretionary | 0.46 |

| 42 | Texas Instruments | Info Tech | 0.43 |

| 43 | NextEra Energy | Utilities | 0.43 |

| 44 | Oracle | Info Tech | 0.43 |

| 45 | Philip Morris | Consumer Staples | 0.43 |

| 46 | Bristol-Myers Squibb | Health Care | 0.42 |

| 47 | Advanced Micro Devices | Info Tech | 0.42 |

| 48 | Wells Fargo | Financials | 0.42 |

| 49 | Netflix | Communication Services | 0.42 |

| 50 | Raytheon Technologies | Industrials | 0.41 |

| 51 | Honeywell | Industrials | 0.38 |

| 52 | United Parcel Service | Industrials | 0.37 |

| 53 | Intel | Info Tech | 0.37 |

| 54 | Amgen | Health Care | 0.37 |

| 55 | Lowe's | Consumer Discretionary | 0.36 |

| 56 | Starbucks | Consumer Discretionary | 0.36 |

| 57 | Union Pacific | Industrials | 0.36 |

| 58 | ConocoPhillips | Energy | 0.36 |

| 59 | AT&T | Communication Services | 0.35 |

| 60 | QUALCOMM | Info Tech | 0.35 |

| 61 | Intuit Inc. | Info Tech | 0.35 |

| 62 | Medtronic Plc | Health Care | 0.35 |

| 63 | Prologis Inc. | Real Estate | 0.34 |

| 64 | S&P Global | Financials | 0.34 |

| 65 | Caterpillar | Industrials | 0.32 |

| 66 | International Business Machines | Info Tech | 0.32 |

| 67 | Boeing | Industrials | 0.32 |

| 68 | Elevance Health | Health Care | 0.32 |

| 69 | Morgan Stanley | Financials | 0.32 |

| 70 | Goldman Sachs Group | Financials | 0.32 |

| 71 | General Electric | Industrials | 0.32 |

| 72 | Intuitive Surgical | Health Care | 0.31 |

| 73 | Mondelez International | Consumer Staples | 0.31 |

| 74 | Lockheed Martin | Industrials | 0.30 |

| 75 | Deere & Company | Industrials | 0.30 |

| 76 | Booking Holdings | Consumer Discretionary | 0.29 |

| 77 | Gilead Sciences | Health Care | 0.29 |

| 78 | Applied Materials | Info Tech | 0.28 |

| 79 | BlackRock | Financials | 0.28 |

| 80 | Stryker | Health Care | 0.28 |

| 81 | Analog Devices | Info Tech | 0.27 |

| 82 | American Tower | Real Estate | 0.26 |

| 83 | American Express | Financials | 0.26 |

| 84 | CVS Health | Health Care | 0.26 |

| 85 | TJX Companies | Consumer Discretionary | 0.26 |

| 86 | Citigroup | Financials | 0.26 |

| 87 | Vertex Pharmaceuticals | Health Care | 0.26 |

| 88 | Automatic Data Processing | Industrials | 0.26 |

| 89 | Marsh & McLennan Companies | Financials | 0.26 |

| 90 | ServiceNow | Info Tech | 0.26 |

| 91 | Zoetis | Health Care | 0.25 |

| 92 | T-Mobile | Communication Services | 0.25 |

| 93 | PayPal | Financials | 0.25 |

| 94 | Altria Group | Consumer Staples | 0.24 |

| 95 | Chubb | Financials | 0.24 |

| 96 | Regeneron Pharmaceuticals | Health Care | 0.24 |

| 97 | Southern Company | Utilities | 0.24 |

| 98 | Cigna | Health Care | 0.23 |

| 99 | Duke Energy | Utilities | 0.22 |

| 100 | Fiserv | Financials | 0.22 |

Over the last decade, big tech names have dominated the index.

The tech sector makes up over 26%, with Apple, Microsoft, and Nvidia as the top S&P 500 companies by market capitalization. Despite interest rates climbing at warp speed, a select number of big tech names have maintained, or even expanded their influence on the index over the last year.

In many cases, investor demand for AI-related stocks has fueled these increases.

Amazon is the third-largest company in the index. While shares tumbled in 2022 amid slowing sales, they have since rebounded by about 46% this year. Like Amazon, consumer discretionary firm Tesla has seen a strong reversal as the index’s 10th biggest stock by weight.

In the financial sector, Berkshire Hathaway has the highest weight (1.7%) while UnitedHealth Group (1.3%) is the top in health care. The health conglomerate even towers above JP Morgan Chase, the biggest bank in America.

S&P 500 Sectors and the Market Cycle

Below, we show the 11 sectors in the S&P 500, organized by weight and their typical performance over the business cycle:

- Cyclical: Rise and fall with the market cycle, often correlated to expansions or contractions

- Defensive: Typically are negatively correlated to the market cycle, with more stable earnings and dividends

| Sector | Weight | Type |

|---|---|---|

| Information Technology | 26.1% | Cyclical |

| Health Care | 14.5% | Defensive |

| Financials | 12.9% | Cyclical |

| Consumer Discretionary | 9.9% | Cyclical |

| Industrials | 8.6% | Cyclical |

| Communication Services | 8.2% | Cyclical |

| Consumer Staples | 7.4% | Defensive |

| Energy | 4.5% | Defensive |

| Utilities | 2.9% | Defensive |

| Materials | 2.6% | Cyclical |

| Real Estate | 2.5% | Cyclical |

Numbers may not total 100 due to rounding.

Information technology, health care, and financials have the highest share in the S&P 500. Together, they cover over half the index.

S&P 500 Companies: Mixed Signals in 2023

In many ways there are two major themes playing out this year so far for U.S. equities, which is the best-performing asset class year to date.

First is that seven big tech companies—Apple, Microsoft, Nvidia, Google, Tesla, Meta, and Amazon—are driving virtually all of the index’s gains. These companies have seen double or triple-digit returns this year so far. As of May 31, tech sector ETFs saw $8 billion in inflows to date, the highest across any sector.

Secondly, the energy and health care sectors have seen the highest outflows, at $9 billion and $4 billion, respectively.

Even with interest rates hitting 15-year highs, extreme greed is in the market, based on the Fear and Greed Index. This may signal higher risk in the S&P 500, since a hit to these few companies with high weightings could significantly affect the broader index.

Markets

The 50 Best One-Year Returns on the S&P 500 (1980-2022)

The highest one-year return among the top S&P 500 stocks from 1980 to 2022 was a staggering 2,620%. Which stocks top the ranks?

The Top S&P 500 Stocks by Annual Returns

The average annual return of the S&P 500 was 10% from 1980-2022, excluding dividends. Of course, there are some companies that deliver much higher returns in any given year.

In this graphic using data from S&P Dow Jones Indices, we explore the top S&P 500 stocks with the best single year returns over the last four decades.

Ranking the Top S&P 500 Stocks

In order to find the top gainers, S&P took the top 10 best-performing stocks each year and then narrowed that list down to the top 50 overall. They ranked the top S&P 500 stocks by price returns, meaning that no dividends or stock distributions were included.

The best gains were clustered in a few select years, including the 1999 dot-com boom, the 2003 stock market rally, and the 2009 recovery from the Global Financial Crisis. None of the biggest gains happened in 2021 or 2022.

| Rank | Company | Sector | Return | Year |

|---|---|---|---|---|

| 1 | Qualcomm | Information Technology | 2620% | 1999 |

| 2 | Tesla | Consumer Discretionary | 743% | 2020 |

| 3 | DSC Communications | Communication Services | 468% | 1992 |

| 4 | Coleco Industries | Consumer Discretionary | 435% | 1982 |

| 5 | Avaya | Information Technology | 428% | 2003 |

| 6 | Chrysler | Consumer Discretionary | 426% | 1982 |

| 7 | XL Capital (Axa XL) | Financials | 395% | 2009 |

| 8 | Tenet Healthcare | Healthcare | 369% | 2009 |

| 9 | Dynegy | Utilities | 361% | 2000 |

| 10 | Advanced Micro Devices | Information Technology | 348% | 2009 |

| 11 | Sprint | Communication Services | 343% | 1999 |

| 12 | Ford | Consumer Discretionary | 337% | 2009 |

| 13 | NEXTEL Communications | Communication Services | 336% | 1999 |

| 14 | LSI Logic | Information Technology | 319% | 1999 |

| 15 | NVIDIA | Information Technology | 308% | 2001 |

| 16 | Nortel Networks | Communication Services | 304% | 1999 |

| 17 | Etsy | Consumer Discretionary | 302% | 2020 |

| 18 | Genworth Financial | Financials | 301% | 2009 |

| 19 | Micron Technology | Information Technology | 300% | 2009 |

| 20 | NetFlix | Communication Services | 298% | 2013 |

| 21 | Oracle | Information Technology | 290% | 1999 |

| 22 | Western Digital | Information Technology | 286% | 2009 |

| 23 | Network Appliance (NetApp) | Information Technology | 270% | 1999 |

| 24 | Data General | Information Technology | 267% | 1991 |

| 25 | Yahoo | Communication Services | 265% | 1999 |

| 26 | Williams Companies | Energy | 264% | 2003 |

| 27 | Novell | Information Technology | 264% | 1991 |

| 28 | Dynegy | Utilities | 263% | 2003 |

| 29 | Sun Microsystems | Information Technology | 262% | 1999 |

| 30 | PMC-Sierra | Information Technology | 262% | 2003 |

| 31 | Advanced Micro Devices | Information Technology | 259% | 1991 |

| 32 | Dell | Information Technology | 248% | 1998 |

| 33 | Global Marine | Energy | 247% | 1980 |

| 34 | Micron Technology | Information Technology | 243% | 2013 |

| 35 | Best Buy | Consumer Discretionary | 237% | 2013 |

| 36 | Reebok | Consumer Discretionary | 234% | 2000 |

| 37 | Freeport-McMoRan | Materials | 229% | 2009 |

| 38 | Biomet (Zimmer Biomet) | Healthcare | 226% | 1991 |

| 39 | NVIDIA | Information Technology | 224% | 2016 |

| 40 | Gap | Consumer Discretionary | 223% | 1991 |

| 41 | NetFlix | Communication Services | 219% | 2010 |

| 42 | Fleetwood Enterprises (Fleetwood RV) | Consumer Discretionary | 217% | 1982 |

| 43 | National Semiconductor | Information Technology | 217% | 1999 |

| 44 | Dell | Information Technology | 216% | 1997 |

| 45 | Tandy Corp (RadioShack) | Information Technology | 216% | 1980 |

| 46 | Novell | Information Technology | 215% | 2003 |

| 47 | Corning | Information Technology | 215% | 2003 |

| 48 | CB Richard Ellis (CBRE) | Real Estate | 214% | 2009 |

| 49 | AES Corp | Utilities | 213% | 2003 |

| 50 | Expedia | Consumer Discretionary | 212% | 2009 |

Qualcomm was by far the top-performer in any one calendar year window. The company had key patents for Code Division Multiple Access (CDMA) technology, which enabled fast wireless internet access and became the basis for 3G networks.

Its stock took off in 1999 as it shed less profitable business lines, resolved a patent dispute with competitor Ericsson, and joined the S&P 500 Index. At the time, CNN reported that one lucky investor who heard about Qualcomm from an investment-banker-turned-rabbi earned $17 million—roughly $30 million in today’s dollars.

The most recent stocks to make the rankings were both from 2020: well-known Tesla (#2) and lesser-known online marketplace Etsy (#17), which saw sales from independent creators surge during the early COVID-19 pandemic. The dollar value of items sold on Etsy more than doubled from $5.3 billion in 2019 to $10.3 billion in 2020, with mask sales accounting for 7% of the total.

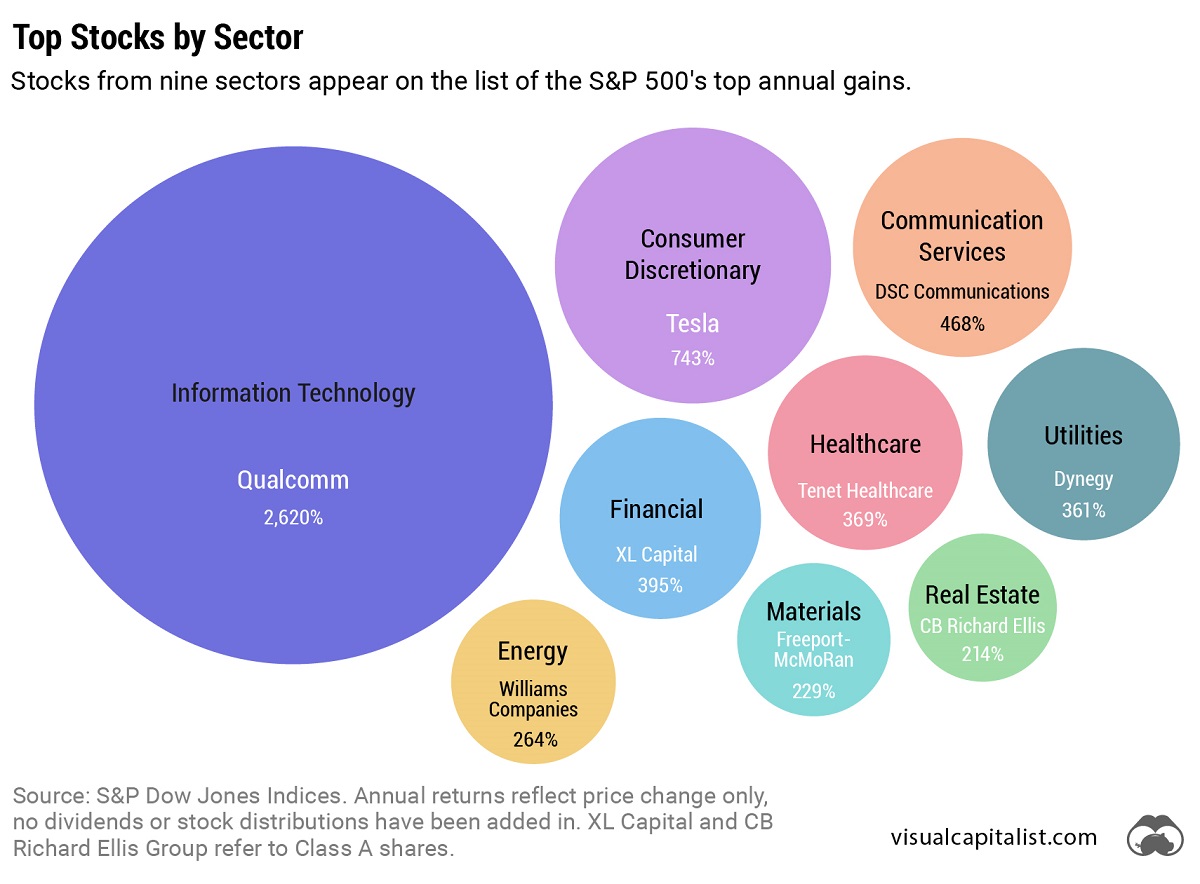

Biggest Gainers in Each Sector

While information technology stocks made up nearly half of the list, there is representation from nine of the 11 S&P 500 sectors. No companies from the Industrials or Consumer Staples sectors made it into the ranks of the top S&P 500 stocks by annual returns.

Below, we show the stock with the best annual return for each sector.

Tesla was the top-performing Consumer Discretionary stock on the list. After meeting the requirement of four consecutive quarters of positive earnings, it joined the S&P 500 Index on December 21, 2020. The company’s performance was boosted by the announcement that it would be included in the S&P 500, along with strong performance in China, and general EV buzz as environmental regulations tightened worldwide.

In the realm of Communication Services, DSC Communications saw a sizable return in 1992. The telecommunications equipment company had contracts with major companies such as Bell and Motorola. Alcatel-Lucent (then Alcatel), a French producer of mobile phones, purchased DSC Communications in 1998.

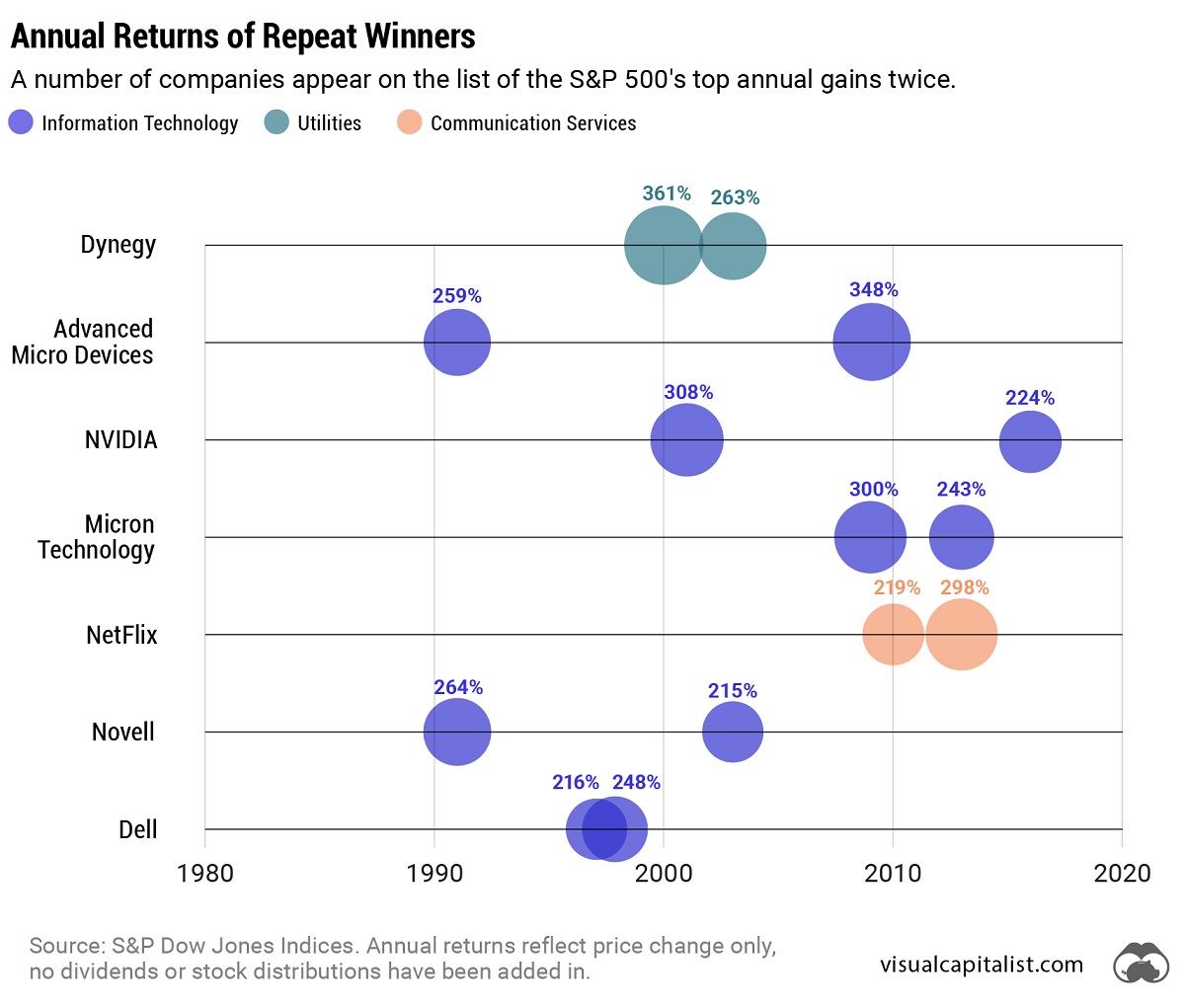

Serial Success Stories

It’s impressive to make the list of the top S&P 500 stocks by calendar returns once, but there are seven companies that have done it twice.

Some stocks saw their repeated outperformance close together, with Dell making the ranks back-to-back in 1997 and 1998.

On the other hand, a select few have more staying power. Computing giant NVIDIA topped the charts in 2001 and triumphed again 15 years later in 2016. And this year might be another win, as the company has recently reached a $1 trillion market capitalization and has the highest year-to-date return in the S&P 500 as of July 6, 2023.

-

Markets1 week ago

Markets1 week agoThe 50 Best One-Year Returns on the S&P 500 (1980-2022)

-

Markets3 weeks ago

Markets3 weeks agoChart: U.S. Home Price Growth Over 50 Years

-

Crime1 week ago

Crime1 week agoMapped: The Most Dangerous Cities in the U.S.

-

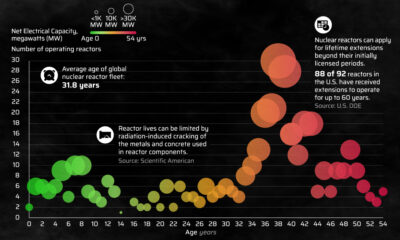

Energy3 weeks ago

Energy3 weeks agoHow Old Are the World’s Nuclear Reactors?

-

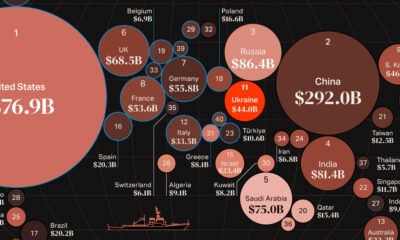

Countries7 days ago

Countries7 days agoMapped: World’s Top 40 Largest Military Budgets

-

Markets3 weeks ago

Markets3 weeks agoHow Big is the Market for Crude Oil?

-

Maps7 days ago

Maps7 days agoMapped: The Safest Cities in the U.S.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Profitable U.S. Companies, by Sector