Money

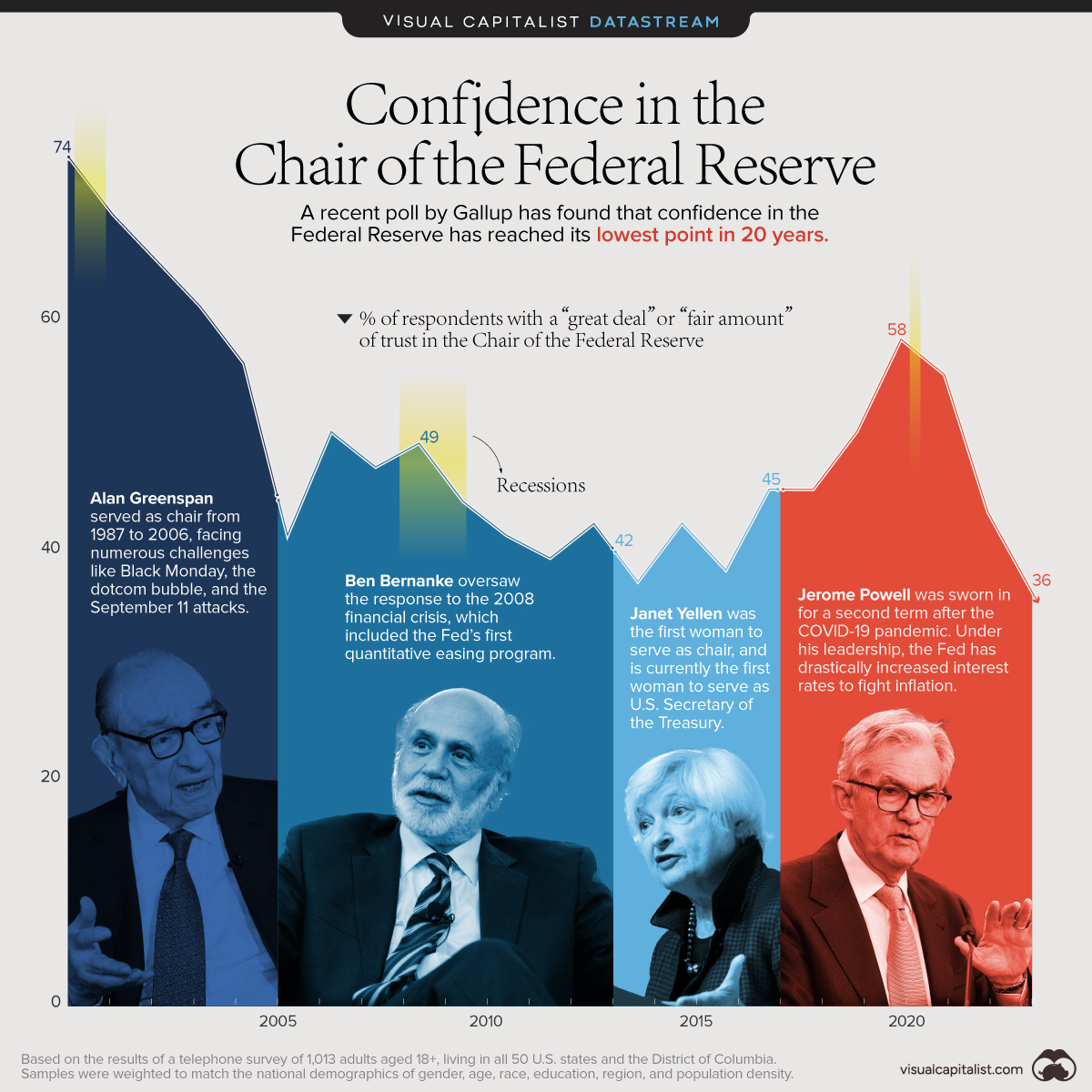

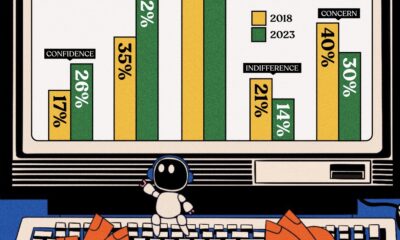

Charted: Public Trust in the Federal Reserve

The Briefing

- Gallup conducts an annual poll to gauge the U.S. public’s trust in the Federal Reserve

- After rising during the COVID-19 pandemic, public trust has fallen to a 20-year low

Charted: Public Trust in the Federal Reserve

Each year, Gallup conducts a survey of American adults on various economic topics, including the country’s central bank, the Federal Reserve.

More specifically, respondents are asked how much confidence they have in the current Fed chairman to do or recommend the right thing for the U.S. economy. We’ve visualized these results from 2001 to 2023 to see how confidence levels have changed over time.

Methodology and Results

The data used in this infographic is also listed in the table below. Percentages reflect the share of respondents that have either a “great deal” or “fair amount” of confidence.

| Year | Fed chair | % Great deal or Fair amount |

|---|---|---|

| 2023 | Jerome Powell | 36% |

| 2022 | Jerome Powell | 43% |

| 2021 | Jerome Powell | 55% |

| 2020 | Jerome Powell | 58% |

| 2019 | Jerome Powell | 50% |

| 2018 | Jerome Powell | 45% |

| 2017 | Janet Yellen | 45% |

| 2016 | Janet Yellen | 38% |

| 2015 | Janet Yellen | 42% |

| 2014 | Janet Yellen | 37% |

| 2013 | Ben Bernanke | 42% |

| 2012 | Ben Bernanke | 39% |

| 2011 | Ben Bernanke | 41% |

| 2010 | Ben Bernanke | 44% |

| 2009 | Ben Bernanke | 49% |

| 2008 | Ben Bernanke | 47% |

| 2007 | Ben Bernanke | 50% |

| 2006 | Ben Bernanke | 41% |

| 2005 | Alan Greenspan | 56% |

| 2004 | Alan Greenspan | 61% |

| 2003 | Alan Greenspan | 65% |

| 2002 | Alan Greenspan | 69% |

| 2001 | Alan Greenspan | 74% |

Data for 2023 collected April 3-25, with this statement put to respondents: “Please tell me how much confidence you have [in the Fed chair] to recommend the right thing for the economy.”

We can see that trust in the Federal Reserve has fluctuated significantly in recent years.

For example, under Alan Greenspan, trust was initially high due to the relative stability of the economy. The burst of the dotcom bubble—which some attribute to Greenspan’s easy credit policies—resulted in a sharp decline.

On the flip side, public confidence spiked during the COVID-19 pandemic. This was likely due to Jerome Powell’s decisive actions to provide support to the U.S. economy throughout the crisis.

Measures implemented by the Fed include bringing interest rates to near zero, quantitative easing (buying government bonds with newly-printed money), and emergency lending programs to businesses.

Confidence Now on the Decline

After peaking at 58%, those with a “great deal” or “fair amount” of trust in the Fed chair have tumbled to 36%, the lowest number in 20 years.

This is likely due to Powell’s hard stance on fighting post-pandemic inflation, which has involved raising interest rates at an incredible speed. While these rate hikes may be necessary, they also have many adverse effects:

- Negative impact on the stock market

- Increases the burden for those with variable-rate debts

- Makes mortgages and home buying less affordable

Higher rates have also prompted many U.S. tech companies to shrink their workforces, and have been a factor in the regional banking crisis, including the collapse of Silicon Valley Bank.

Where does this data come from?

Source: Gallup (2023)

Data Notes: Results are based on telephone interviews conducted April 3-25, 2023, with a random sample of –1,013—adults, ages 18+, living in all 50 U.S. states and the District of Columbia. For results based on this sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level. See source for details.

Politics

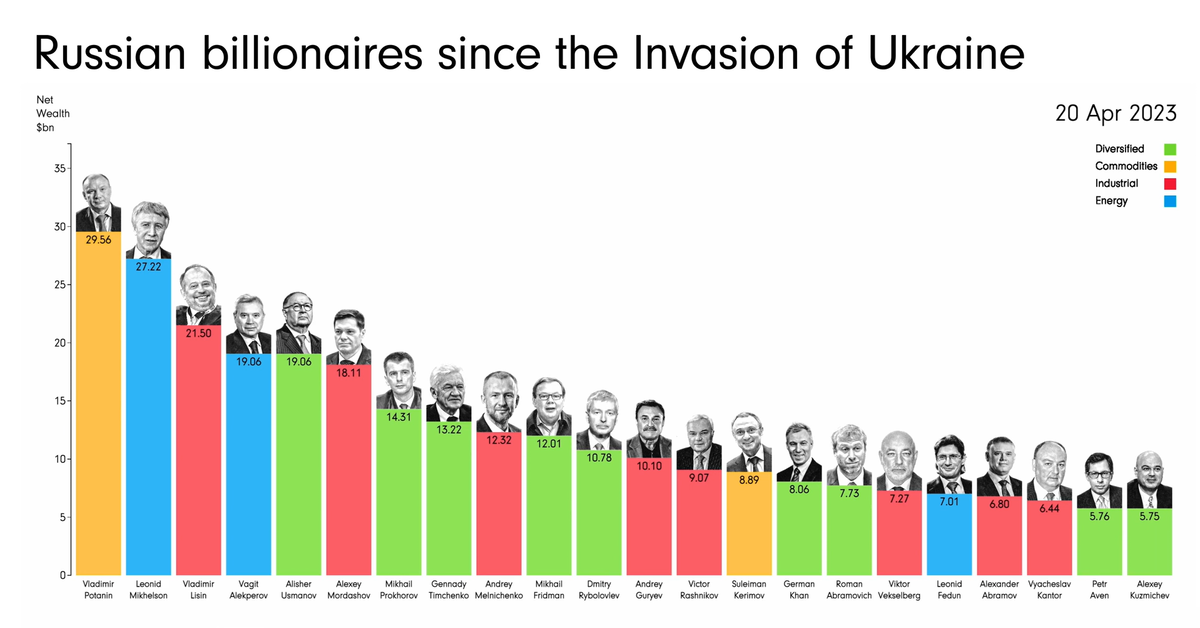

Animated: Change in Russian Billionaires’ Wealth Since 2022

How have Russian billionaires fared since Russia’s invasion of Ukraine? This animation tracks the wealth of 22 Russian billionaires.

Animated: Change in Russian Billionaires’ Wealth Since 2022

When Russia invaded Ukraine in February 2022, many countries retaliated with sanctions targeting Russian billionaires—the oligarchs—and politicians directly.

And as the war has progressed, those sanctions have intensified, with even the relatives and shell companies of these billionaires being targeted over time. The reason? These oligarchs are interconnected to Russia’s government, lending vocal and fiscal support in exchange for sweetheart deals or beneficial government oversight.

This animation from James Eagle shows how the estimated net wealth of the 22 wealthiest Russian billionaires on the Bloomberg Billionaires Index in April 2023 has changed since January 2022, prior to the start of the conflict.

Net Wealth of Top Russian Billionaires

The 22 wealthiest Russian billionaires in April 20, 2023 lost a collective $90.4 billion in net worth since January 5, 2022.

| Rank | Name | Main Industry | Net Wealth (Apr 20, 2023) | Net Wealth (Jan 5, 2022) | % Change |

|---|---|---|---|---|---|

| 1 | Vladimir Potanin | Commodities | $29.6B | $31.1B | -4.8% |

| 2 | Leonid Mikhelson | Energy | $27.2B | $33.2B | -18.1% |

| 3 | Vladimir Lisin | Industrial | $21.5B | $28.0B | -23.2% |

| 4 | Vagit Alekperov | Energy | $19.1B | $22.8B | -16.2% |

| 5 | Alisher Usmanov | Diversified | $19.1B | $21.2B | -9.9% |

| 6 | Alexey Mordashov | Industrial | $18.1B | $29.1B | -37.8% |

| 7 | Mikhail Prokhorov | Diversified | $14.3B | $14.0B | 2.1% |

| 8 | Gennady Timchenko | Diversified | $13.2B | $23.1B | -42.9% |

| 9 | Andrey Melnichenko | Industrial | $12.3B | $17.8B | -30.9% |

| 10 | Mikhail Fridman | Diversified | $12.0B | $14.1B | -14.9% |

| 11 | Dmitry Rybolovlev | Diversified | $10.8B | $11.2B | -3.6% |

| 12 | Andrey Guryev | Industrial | $10.1B | $8.0B | 26.3% |

| 13 | Victor Rashnikov | Industrial | $9.1B | $14.4B | -36.8% |

| 14 | Suleiman Kerimov | Commodities | $8.9B | $15.2B | -41.4% |

| 15 | German Khan | Diversified | $8.1B | $9.6B | -15.6% |

| 16 | Roman Abramovich | Diversified | $7.7B | $18.2B | -57.7% |

| 17 | Viktor Vekselberg | Industrial | $7.3B | $18.6B | -60.8% |

| 18 | Leonid Fedun | Energy | $7.0B | $8.9B | -21.3% |

| 19 | Alexander Abramov | Industrial | $6.8B | $9.1B | -25.3% |

| 20 | Vyacheslav Kantor | Industrial | $6.4B | $9.1B | -29.7% |

| 21 | Petr Aven | Diversified | $5.8B | $6.6B | -12.1% |

| 22 | Alexey Kuzmichev | Diversified | $5.8B | $7.3B | -20.5% |

The heaviest hit include Viktor Vekselberg, who holds a stake in UC Rusal, the world’s third largest aluminum producer. Since the start of the war, he’s lost an estimated $11.3 billion or 61% of his net worth from January 2022.

Roman Abramovich, who got his start in the early oligarchy through oil conglomerates, was also hit hard by the sanctions. He lost $10.5 billion or 58% of his net worth from January 2022, and was forced to sell Chelsea Football Club in one of the biggest sports team sales in history.

Notably, the richest oligarchs haven’t lost as much. Mining giant Norilsk Nickel’s largest shareholder, Vladimir Potanin, saw his net worth only drop by 4.8%. After being hit hard at the onset of the war in Ukraine, he quickly rebounded and at many times had an even higher net worth, reaching $35.6 billion in June 2022.

And a few oligarchs, like former Norilsk Nickel CEO Mikhail Prokhorov and phosphate-based fertilizer baron Andrey Guryev, saw their wealth increase since January 2022. Guryev grew his net worth by $2 billion or 26%, while Prokhorov (who formerly owned the NBA’s Brooklyn Nets) saw his net worth even out at a gain of $0.3 billion or 2%.

Oligarch Support of Russia (or Lack Thereof)

As Russia’s war with Ukraine has dragged on, and sanctions have continued to weigh on Russian billionaires, politicians, and companies, their effects have been uncertain.

Oligarchs have lost net worth, relinquished foreign businesses, and even had prized possessions like mansions and yachts seized. At the same time, though Russia’s economy has weakened under sanctions, bolstered trade with countries like China, India, and Saudi Arabia have kept it stronger than expected.

And though some oligarchs have voiced various concerns over the ongoing war, the wealthiest have been careful to toe the line. Russian billionaires and politicians that did vocalize criticism, including Lukoil chairman Ravil Maganov, have been found dead in apparent suicides, heart attacks, and accidents.

The most serious oligarch rebellion wasn’t due to economic hardships, but military operations. Oligarch and mercenary leader Yevgeny Prigozhin launched an attempted coup in June 2023, reportedly retreating after support from within Russia’s military quickly fizzled.

-

Stocks3 weeks ago

Stocks3 weeks agoWhat are Top Investment Managers Holding in Their Portfolios?

-

Stocks1 week ago

Stocks1 week agoThe 50 Best One-Year Returns on the S&P 500 (1980-2022)

-

Markets3 weeks ago

Markets3 weeks agoChart: U.S. Home Price Growth Over 50 Years

-

Cities1 week ago

Cities1 week agoMapped: The Most Dangerous Cities in the U.S.

-

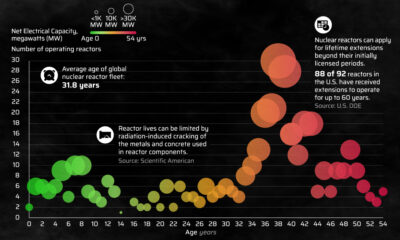

Energy3 weeks ago

Energy3 weeks agoHow Old Are the World’s Nuclear Reactors?

-

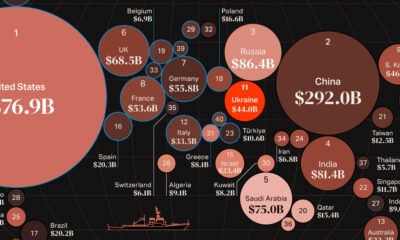

Countries7 days ago

Countries7 days agoMapped: World’s Top 40 Largest Military Budgets

-

Energy3 weeks ago

Energy3 weeks agoHow Big is the Market for Crude Oil?

-

United States6 days ago

United States6 days agoMapped: The Safest Cities in the U.S.

Creator Program

Creator Program