Technology

Ranked: America’s Largest Semiconductor Companies

![]()

Ranking America’s Largest Semiconductor Companies

As our world moves further into an era of widespread digitization, few industries can be considered as important as semiconductors.

These components are found in almost everything we use on a daily basis, and the ability to produce them domestically has become a topic of national security. For example, in 2022 the Biden administration announced the CHIPS and Science Act, which aims to strengthen America’s position in everything from clean energy to artificial intelligence.

With this in mind, we’ve ranked the top 15 U.S. semiconductor companies by their market capitalizations.

Data and Highlights

The data we used to create this infographic is listed in the table below. Year-to-date (YTD) returns were included for additional context. Both metrics are as of May 30, 2023.

| Rank | Company | Ticker | Market Cap (USD billions) | YTD Return |

|---|---|---|---|---|

| 1 | Nvidia | NVDA | $992 | 180.2% |

| 2 | Broadcom | AVGO | $335 | 45.1% |

| 3 | AMD | AMD | $202 | 95.7% |

| 4 | Texas Instruments | TXN | $160 | 8.2% |

| 5 | Qualcomm | QCOM | $129 | 8.2% |

| 6 | Intel | INTC | $125 | 12.2% |

| 7 | Applied Materials | AMAT | $115 | 41.2% |

| 8 | Analog Devices | ADI | $89 | 9.2% |

| 9 | Lam Research | LRCX | $85 | 52.1% |

| 10 | Micron Technology | MU | $78 | 42.3% |

| 11 | Snyopsys | SNPS | $71 | 45.4% |

| 12 | KLA | KLAC | $63 | 21.8% |

| 13 | Marvell Technology Group | MRVL | $54 | 76.2% |

| 14 | Microchip Technology | MCHP | $42 | 11.2% |

| 15 | ON Semiconductor | ON | $36 | 36.3% |

At the top is Nvidia, which became America’s newest $1 trillion company on Tuesday, May 30th. Shares pulled back slightly over the day and Nvidia closed at $992 billion. Over the past decade, Nvidia has transformed from a gaming-focused graphics card producer to a global leader in AI and data center chips.

In third and sixth place are two of America’s most well known chipmakers, AMD and Intel. These longtime rivals are moving in opposite trajectories, with AMD shares climbing 770% over the past five years, and Intel shares falling 47%. One reason for this is the data center segment, in which AMD appears to be stealing market share from Intel.

Further down the list we see Applied Materials in seventh, and Lam Research in ninth. Both firms specialize in semiconductor manufacturing equipment and thus play an important role in the industry’s supply chain.

Trade War Impacts

As tensions between the U.S. and China escalate, chipmakers are becoming increasingly entangled in geopolitical conflict.

In October 2022, the Biden administration introduced new export controls aimed at blocking China’s access to semiconductors produced with U.S. equipment. This impacted several companies in our top 15 list, including Lam Research and Applied Materials.

Shortly after the export controls were announced, Lam Research said it expected to lose upwards of $2.5 billion in annual revenues.

We lost some very profitable customers in the China region, and that’s going to persist, obviously.

– Doug Bettinger, CFO, Lam Research

In response, China announced in May 2023 that it would no longer allow America’s largest memory chipmaker, Micron, to sell its products to “critical national infrastructure operators”.

This is not the first time Micron has been involved in a controversy with China. In 2018, the firm alleged that Fujian Jinhua Integrated Circuit, a Chinese state-owned company, had solicited a Micron employee to steal specifications for memory chips. The U.S. Department of Commerce imposed export restrictions on Fujian Jinhua as a result.

Chipmakers on both sides of the Pacific will be closely watching as competition between these two countries heats up.

apps

How Long it Took for Popular Apps to Reach 100 Million Users

Threads reached 100 million users in just five days. Here is a timeline of how long other popular platforms took to reach the milestone.

How Long it Took for Popular Apps to Reach 100 Million Users

Of Twitter’s many new rivals, Meta’s newest social media platform Threads has established its presence with a bang.

According to Meta founder Mark Zuckerberg, Threads took only 5 days to reach the key threshold of 100 million users. It achieved this milestone through organic demand—and no paid promotions required—smashing all previous records.

But how long have other popular platforms—TikTok, Instagram, and YouTube to name a few—taken to build their user base? Pulling data from PwC and Yahoo, we rank how long it took popular platforms to get to 100 million users.

Ranking Every Apps Journey to 100 Million Users

In first place, Threads has a significant lead over the rest of the pack with its five day achievement, and may have built a significant moat in holding on to this record.

Firstly, its launch coincided with Twitter’s viewing limit decision, and rode the wave of dissatisfaction aimed at Twitter’s current owner, Elon Musk.

Secondly, new users on Threads need an Instagram account to register, thus eliminating sign-up barriers and leveraging Instagram’s 1.2 billion-strong user base.

Here’s the journey length of popular platforms to attaining 100 million users:

| Rank | Platform | Launch | Time to 100M Users |

|---|---|---|---|

| 1 | Threads | 2023 | 5 days |

| 2 | ChatGPT | 2022 | 2 months |

| 3 | TikTok | 2017 | 9 months |

| 4 | 2011 | 1 year, 2 months | |

| 5 | 2010 | 2 years, 6 months | |

| 6 | Myspace | 2003 | 3 years |

| 7 | 2009 | 3 years, 6 months | |

| 8 | Snapchat | 2011 | 3 years, 8 months |

| 9 | YouTube | 2005 | 4 years, 1 month |

| 10 | 2004 | 4 years, 6 months | |

| 11 | Spotify | 2006 | 4 years, 7 months |

| 12 | Telegram | 2013 | 5 years, 1 month |

| 13 | 2006 | 5 years, 5 months | |

| 14 | Uber | 2011 | 5 years, 10 months |

| 15 | 2010 | 5 years, 11 months | |

| 16 | Google Translate | 2006 | 6 years, 6 months |

| 17 | World Wide Web | 1991 | 7 years |

| 18 | 2003 | 7 years, 11 months |

Ranked second, Open AI’s ChatGPT launched in November 2022 and hit 100 million users by the start of the new year. ChatGPT introduced the incredible capabilities of large language models to the masses, prompting a rush of sign-ups, and reviving old conversations around the potential consequences of AI.

Coming in at third place, ByteDance’s TikTok took just 9 months to reach 100 million users after its launch in 2017. Like Threads, TikTok benefited from another app, accessing popular lip syncing app Musical.ly’s existing user base after it was acquired and folded into TikTok.

WeChat and Instagram round out the top-five, also with interesting advantages. WeChat, an instant messaging platform similar to WhatsApp, benefited from its unique access to China’s notoriously closed internet market of 500 million users in 2012.

Meanwhile, Meta acquired Instagram when the photo-sharing platform had 30 million users, and more than tripled that number past 100 million in just one year.

And while Facebook ranks solidly middle-of-the-pack for fastest to 100 million users, it remains the platform with the most monthly active accounts, at nearly 3 billion. In fact, Meta’s lessons learned from Facebook have been well-leveraged, and the company owns 4 of the fastest apps to register 100 million users.

So What Does Threads Success Mean for Twitter?

Coming back to Threads’ incredible feat, however, it’s still early days whether an en-masse switch from Twitter is on the cards for Meta’s newest platform.

For one, Threads has faced significant criticism due to its intensive data collection practices and lack of accessibility features. It also is missing some key features from its rival, including trending topics, hashtags, and direct messages.

Meanwhile Elon Musk has been less than pleased with Threads’ success, deeming it a copy of Twitter and even threatening legal action.

Competition is fine, cheating is not

— Elon Musk (@elonmusk) July 6, 2023

So where does this leave the increasingly-crowded social media space? The next decade will set the stage for either more platform consolidation, or even further audience fragmentation.

-

United States3 weeks ago

United States3 weeks agoVisualized: The 100 Largest U.S. Banks by Consolidated Assets

-

Technology1 week ago

Technology1 week agoCharted: Changing Sentiments Towards AI in the Workplace

-

Stocks3 weeks ago

Stocks3 weeks agoWhat are Top Investment Managers Holding in Their Portfolios?

-

Markets1 week ago

Markets1 week agoThe 50 Best One-Year Returns on the S&P 500 (1980-2022)

-

United States3 weeks ago

United States3 weeks agoChart: U.S. Home Price Growth Over 50 Years

-

Crime1 week ago

Crime1 week agoMapped: The Most Dangerous Cities in the U.S.

-

Energy3 weeks ago

Energy3 weeks agoHow Old Are the World’s Nuclear Reactors?

-

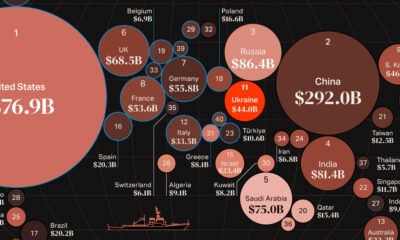

Countries7 days ago

Countries7 days agoMapped: World’s Top 40 Largest Military Budgets