VC+

What’s New on VC+ in July

If you’re a regular visitor to Visual Capitalist, you know that we’re your home base for data-driven, visual storytelling that helps explain a complex world.

But did you know there’s a way to get even more out of Visual Capitalist, all while helping support the work we do?

VC+ is our members program that gives you exclusive access to the weekly visual insights that leaders at Fortune 500 companies use to stay ahead.

Along with The Trendline newsletter twice a week and our monthly special dispatches, you’ll also get access to our VC+ Archive—unlocking hundreds of our in-depth briefings and insights in one place.

Here’s what VC+ members can look forward to for the rest of this month:

New to VC+ in July 2023

“Five Historical Maps and the Details That Make Them Fascinating”

SPECIAL DISPATCH: Exploring the World of Cartography Through the Lens of Design

In the pre-computer era, mapmaking was one of the most complex and challenging design endeavors.

In this special dispatch, we’ve handpicked five interesting maps for you to explore, from 19th century Egypt to WWII-era Tokyo. Along with each map, we’ll point out details to start you off in your journey of cartographic exploration.

Coming Monday, July 17th, 2023 (Get VC+ to access)

“Behind the Scenes of Voronoi: Building a Data Storytelling Platform”

SPECIAL DISPATCH: Exclusive Q&A With the VC Team On Insights From Our Upcoming App

At Visual Capitalist, we stand for a world where data can be better understood by everyone. In order to achieve this vision, we embarked on a journey back in 2022 to create the world’s first creator-centric, mobile data storytelling platform called Voronoi.

This special dispatch offers a look into the final stages of building our upcoming platform in an exclusive Q&A from the VC team, uncovering the development of new features along with release plans and more.

Coming Monday, July 24th, 2023 (Get VC+ to access)

The Trendline

PREMIUM NEWSLETTER: Our Bi-Weekly Newsletter for VC+ Members

The Sunday Edition The Midweek Edition

The Best Visualizations Each Week The Best Data and Reports Each Week

>> View free sample >> View free sample

The Trendline is our premium newsletter sent to members twice a week.

On Sundays, we highlight the best visualizations on business, investing, and global trends that our editors have uncovered. On Thursdays in the Midweek Edition, we send you a round-up of the most interesting reports we find along with key charts and commentary.

The Trends Shaping the World—in Your Inbox

Get access to these upcoming features by becoming a VC+ member. And for a limited time, get 25% off, which makes your VC+ membership the same price as a coffee each month:

PS – We look forward to sending you even more great visuals and data!

Stocks

What are Top Investment Managers Holding in Their Portfolios?

In this excerpt from our Markets This Month VC+ newsletter, we looked at how five portfolios of super investors shaped up at end of Q1 2023.

The following is an complimentary excerpt from our Markets This Month dispatch from our premium newsletter called VC+. For more like this, get a VC+ annual membership for 25% off.

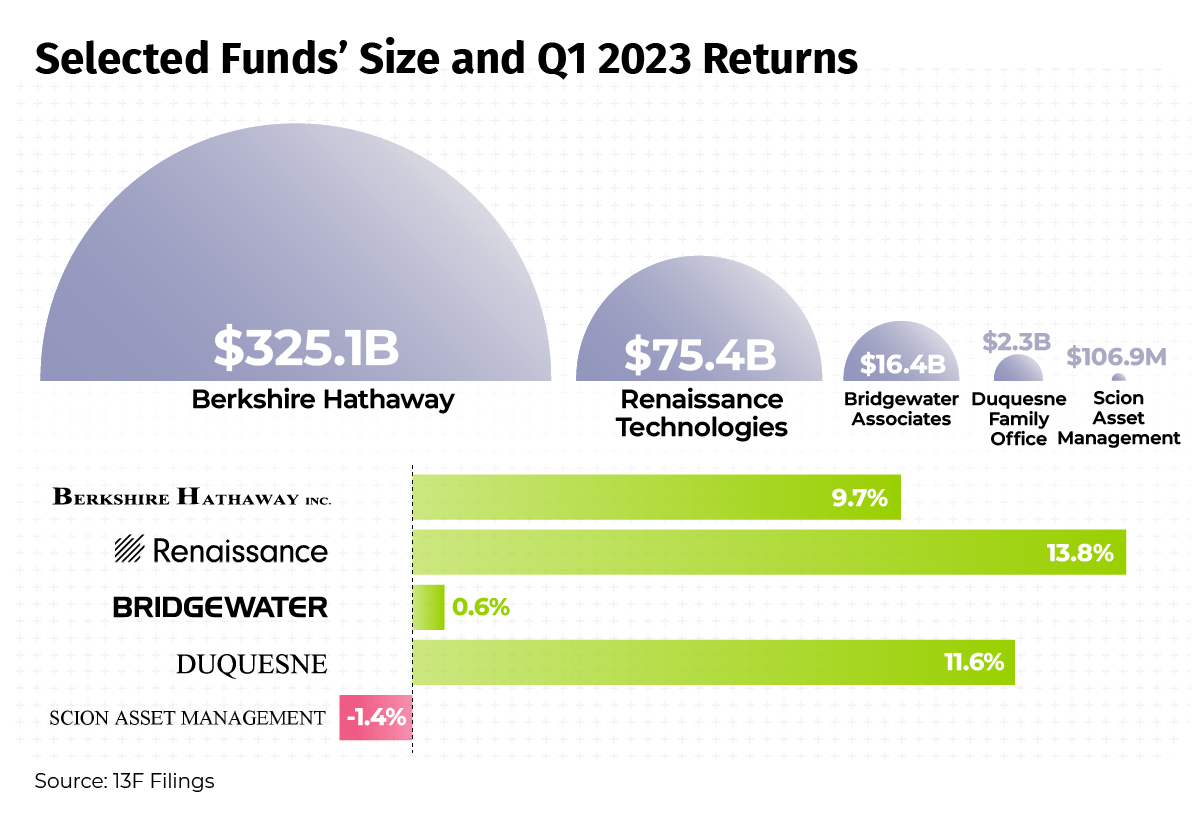

Analyzing the Funds of Five “Super Investors”

With the market usually taking a breather during the summer, it’s a great opportunity to analyze how top funds positioned their portfolios at the end of Q1 2023.

We selected five funds of various sizes, each one with a renowned investor at its helm that often has a unique outlook on the market and strategy towards building out their portfolio.

The differences in portfolio compositions underline the variety of investment strategies, showing how some of the top investors approach portfolio construction.

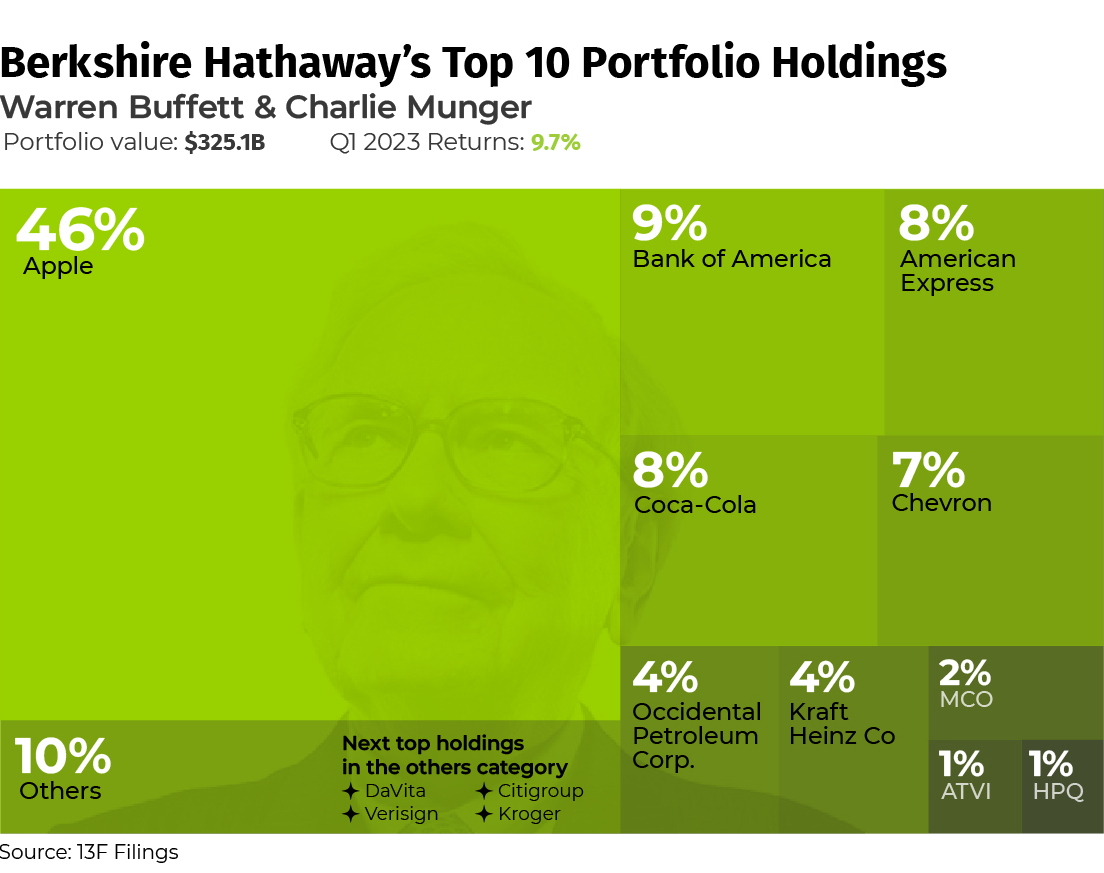

Berkshire Hathaway has one of the world’s best known and most successful portfolios, which has significantly outperformed the S&P 500 over the long term.

While the S&P 500 has returned 195% since 2013, Warren Buffett and Charlie Munger’s fund grew by 260% over the same time period.

Although Buffett is known for preaching diversification, almost half of Berkshire’s portfolio is all in the market’s most valuable company, Apple. The rest of the portfolio is fairly diversified with a mix of bank stocks, consumer staples like Coca-Cola and Kraft, along with oil and gas companies.

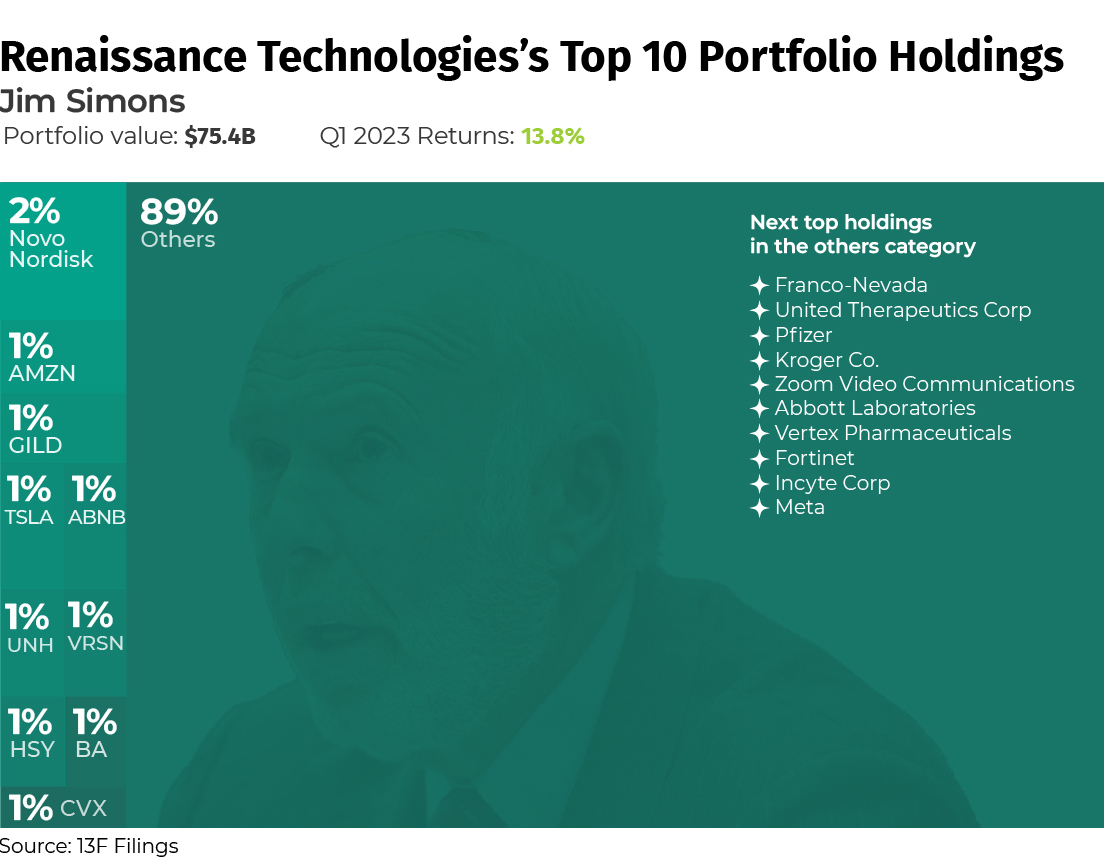

Jim Simons’ hedge fund, Renaissance Technologies, is best known for its groundbreaking use of complex mathematical models and algorithms which pioneered the practice of quantitative investing.

As a result, the hedge fund’s portfolio holdings showcase astounding diversification, with the fund’s largest holding being a 2% allocation to pharmaceutical giant Novo Nordisk.

The portfolio is split across more than 3,900 different positions, showcasing the fund’s strategy of squeezing out returns from a diverse collection of investments through its algorithm-driven, statistical arbitrage approach.

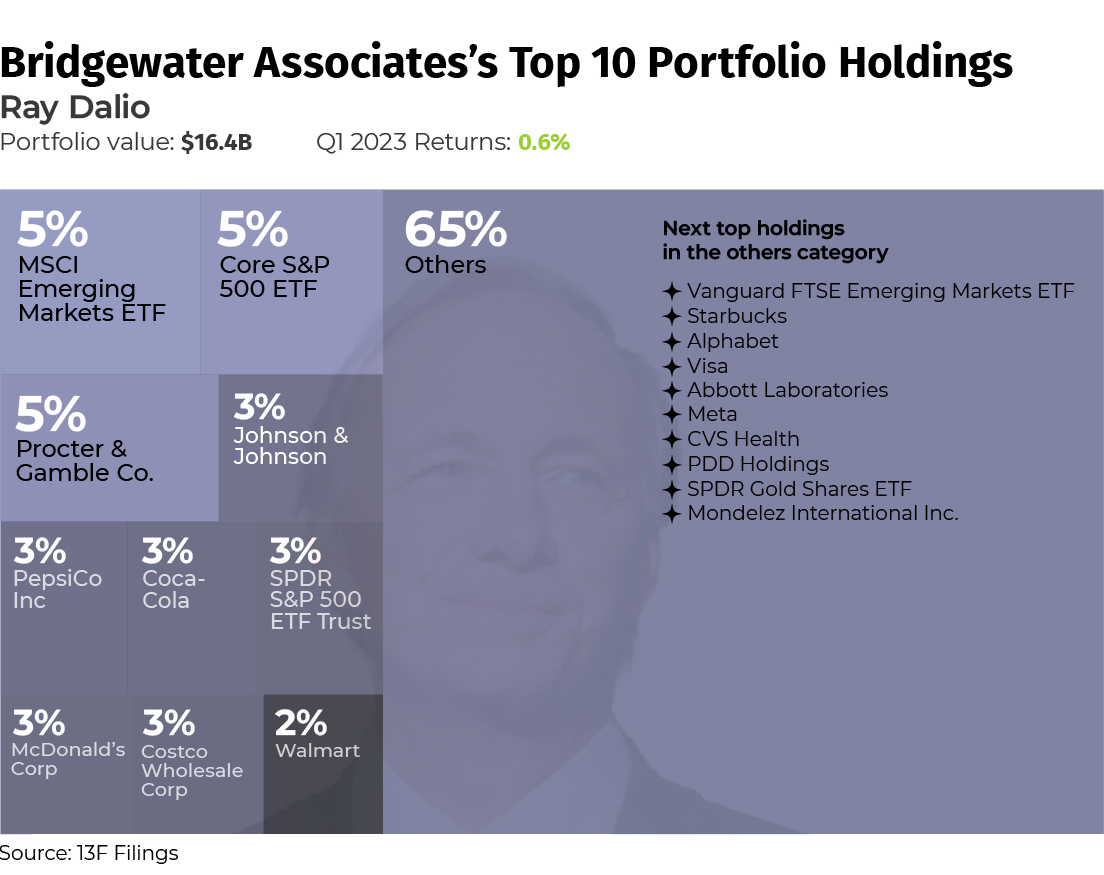

Ray Dalio’s Bridgewater Associates was one of the few hedge funds to predict and successfully navigate the 2008 financial crisis, largely thanks to its “all weather” strategy which looks to perform well in all economic environments through diversification and a risk-parity approach to asset allocation.

As a result, you see many parallels and “counterweights” in the fund’s holdings. Its largest holding of MSCI’s Emerging Markets ETF is balanced out by the Core S&P 500 ETF.

Bridgewater is also one of the few funds which holds shares in a gold ETF. While other funds we’ve looked at have investments in gold royalty companies or miners, which likely have strong balance sheets and businesses to support the investment, Dalio’s fund has preferred to invest directly in the precious metal.

Stanley Druckenmiller is best known as having been a key strategist for George Soros’s Quantum Fund, along with his own consistent record of returns with Duquesne which average 30% annually.

Known for his macroeconomic approach to investing, Druckenmiller isn’t afraid to make unique and concentrated bets when he has high conviction.

Currently his highest conviction bet and largest holding in his portfolio is Coupang Inc., which is South Korea’s largest online marketplace. Along with Coupang, Druckenmiller positioned his fund to take advantage of this year’s AI boom, with significant holdings in companies like NVIDIA, Microsoft, and Alphabet.

The smallest of all five funds we looked at, Michael Burry’s Scion Asset Management might be one of the best known for its role in predicting the 2008 financial crisis early on.

The protagonist of the film, The Big Short, Michael Burry is best known for his aggressive short bets and overall value investing approach especially in distressed assets.

Scion Asset Management’s portfolio reflects this as a good portion of its holdings at the end of Q1 this year were in various bank stocks which had declined significantly throughout the month of March.

Burry’s biggest bets however are in Chinese ecommerce companies JD.com and Alibaba, indicating Burry’s belief in a consumer driven economic reopening for China this year.

|

Markets This Month by VC+

We hope you enjoyed this excerpt by Niccolo Conte from Markets This Month, which hits VC+ subscribers’ inboxes every month. Get 25% off an annual subscription to VC+ by clicking here. |

-

Green5 days ago

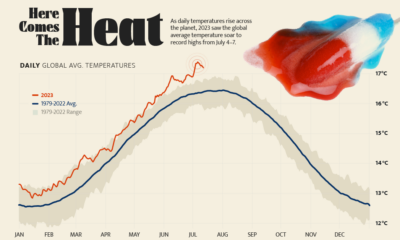

Green5 days agoHotter Than Ever: 2023 Sets New Global Temperature Records

-

Datastream4 weeks ago

Datastream4 weeks agoCan You Calculate Your Daily Carbon Footprint?

-

Energy2 weeks ago

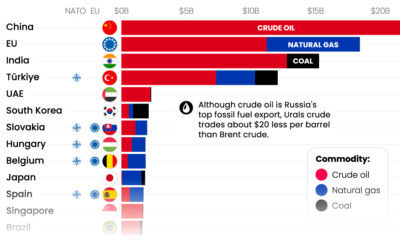

Energy2 weeks agoWho’s Still Buying Russian Fossil Fuels in 2023?

-

China14 hours ago

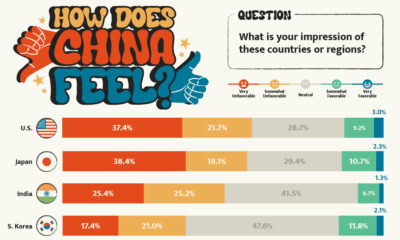

China14 hours agoHow Do Chinese Citizens Feel About Other Countries?

-

Investor Education4 weeks ago

Investor Education4 weeks agoVisualizing BlackRock’s Top Equity Holdings

-

Technology2 weeks ago

Technology2 weeks agoMeet the Competing Apps Battling for Twitter’s Market Share

-

Markets4 weeks ago

Markets4 weeks agoVisualizing Every Company on the S&P 500 Index

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing 1 Billion Square Feet of Empty Office Space